Dissolving a business is a significant decision and involves more than just stopping operations. It's a formal process that requires careful planning and compliance with legal and financial obligations to ensure a smooth transition. Here's a comprehensive guide on business...

How to Amend a Tax Return: Process, Reasons, and What to Know

Amending your taxes may sound intimidating, but it doesn’t have to be. A tax amendment is your chance to correct mistakes, claim overlooked deductions or credits, or adjust reported income. By filing an amended return properly, you can stay compliant...

Smart Tax Tips and Tricks for Individuals and Business Owners

Understanding how to make the most of tax rules can lead to substantial savings and better financial planning. Whether you’re an individual filer or a business owner, this guide offers practical strategies to improve your tax position and reduce your...

Check Your IRS Tax Return Status

Your Step-By-Step Guide to Staying Informed About Your Tax Return Learn how to track the status of your tax return using IRS tools, mobile apps, and professional guidance. Stay informed to avoid delays and plan with confidence. How to Track...

How to File Your Personal Taxes: Key Steps Explained

Filing your personal taxes may seem daunting, but with the right approach, it becomes a manageable annual task. This guide walks you through the process step by step, helping you stay organized, avoid common mistakes, and take advantage of available...

Personal Taxes Explained: A Complete Guide

What Are Personal Taxes? Personal taxes, commonly referred to as income taxes, are paid by individuals, couples, and families based on how much they earn. These taxes help fund essential public services and infrastructure. Understanding how personal taxes work can...

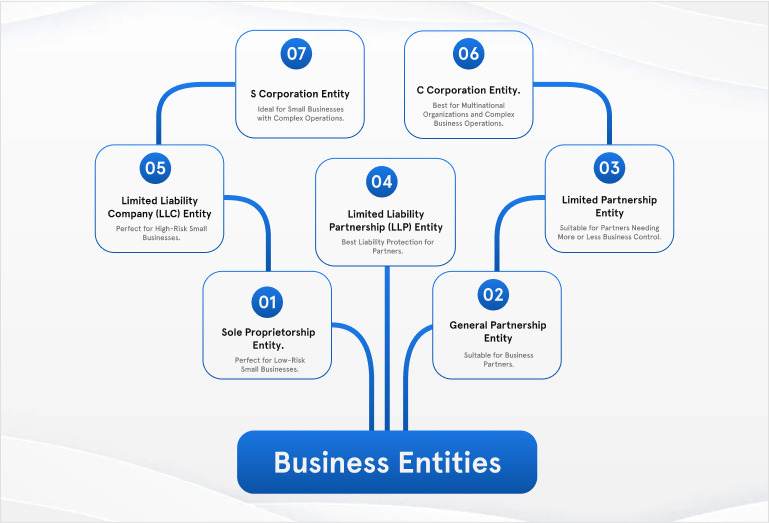

Entities Comparison Chart

Here's a comparison chart that outlines the key aspects of different entity types regarding ownership, tax treatment, liability protection, and tax filing requirements: Entity TypeOwnershipTax TreatmentLiability ProtectionTax FilingSole ProprietorshipSingle ownerIncome and losses reported on owner’s personal tax return; subject to...

How to File an S Corp Election: Save on Taxes & Stay Compliant

Choosing to elect S corporation status can offer key tax benefits and legal protections for eligible businesses. This guide explains what an S corporation is, who qualifies, how to file, and the practical do’s and don’ts to help you navigate...

Understanding Small Business Taxes: A Practical Guide

Managing small business taxes can feel overwhelming, but with the right approach you can stay compliant, reduce liabilities, and protect your financial health. This guide explains the types of taxes small businesses face, the steps for filing correctly, and practical...

Understanding Corporate Tax: What It Is, How It Works, and How to File

Corporate tax is one of the biggest responsibilities for any business, yet it's also one of the most misunderstood and often the most daunting. At its simplest, it's a tax on a company’s profits, but the rules, deadlines, and strategies...

How to File Business Taxes: A Practical Guide for Accuracy and Compliance

Filing business taxes is a necessary responsibility that impacts the financial and legalstability of your business. Whether you operate as a sole proprietorship or a corporation,understanding how taxes work and preparing accordingly can help you avoid penalties,reduce liabilities, and plan...

Annual Reports: Filing Requirements, Purpose, and Importance

Annual reports are documents that businesses are often required to submit to the state they're registered in. These reports play a critical role in maintaining transparency with regulatory bodies and keeping the public informed about the company's financial and operational...

Understanding Business License Search: How to Conduct, Where to Search, and Its Importance

Navigating the world of business involves understanding and adhering to various regulatory requirements, one of which is obtaining and maintaining appropriate business licenses. A business license search is an essential step for anyone looking to verify the legitimacy of a...

Understanding EINs: Purpose, Application Process, and Uses

What is an EIN? An Employer Identification Number (EIN), also known as a Tax Identification Number (TIN) or Federal Employer Identification Number (FEIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in...

Understanding Registered Agents: Role, Use, and Importance in the Tax Filing Process

When forming a business, one of the key decisions you'll need to make involves the appointment of a registered agent. This role is crucial for legal and tax compliance, ensuring that your business operates smoothly within the framework of state...

Understanding Entity Types and Their Tax Implications

When forming a business or managing finances, choosing the right entity type is a crucial decision with legal, operational, and tax consequences. The structure you choose affects liability exposure, tax obligations, and regulatory filings. Common Entity Types and Tax-Related Considerations...

Essential U.S. Tax Laws: Key Rules, Deadlines, and Tax Tips for Individuals and Businesses

Understanding key tax laws helps individuals and businesses make informed decisions, maximize savings, and stay compliant. Learn how income tax, deductions, employment taxes, and capital gains impact your financial strategy. Accurate filing and smart planning will help you achieve long-term...

Glossary of Tax and Business Terms

Annual Report: A required yearly document that corporations file with the state, summarizing financial performance and business activities. Read our guide to annual reports. Articles of Dissolution: Legal papers filed to formally close a corporation or LLC and end its...

Managing Small Business Taxes: Strategies, Compliance, and Key Tips

Managing taxes is a critical aspect of running a small business. Properly handling your taxobligations not only keeps your business compliant with regulations, but it can alsostrengthen financial health by maximizing deductions and avoiding penalties. This guideexplains why tax management...

Understanding Taxes: A Clear Guide for Individuals and Small Businesses

Navigating taxes doesn’t have to be overwhelming. Whether you’re filing for the first time or working to improve your financial literacy, understanding the fundamentals of taxation can help you stay compliant, reduce liabilities, and plan ahead with confidence. This guide...