Here's a comparison chart that outlines the key aspects of different entity types regarding ownership, tax treatment, liability protection, and tax filing requirements: Entity TypeOwnershipTax TreatmentLiability ProtectionTax FilingSole ProprietorshipSingle ownerIncome and losses reported on owner’s personal tax return; subject to...

How to File an S Corp Election: Save on Taxes & Stay Compliant

Choosing to elect S corporation status can offer key tax benefits and legal protections for eligible businesses. This guide explains what an S corporation is, who qualifies, how to file, and the practical do’s and don’ts to help you navigate...

Understanding Corporate Tax: What It Is, How It Works, and How to File

Corporate tax is one of the biggest responsibilities for any business, yet it's also one of the most misunderstood and often the most daunting. At its simplest, it's a tax on a company’s profits, but the rules, deadlines, and strategies...

How to File Business Taxes: A Practical Guide for Accuracy and Compliance

Filing business taxes is a necessary responsibility that impacts the financial and legalstability of your business. Whether you operate as a sole proprietorship or a corporation,understanding how taxes work and preparing accordingly can help you avoid penalties,reduce liabilities, and plan...

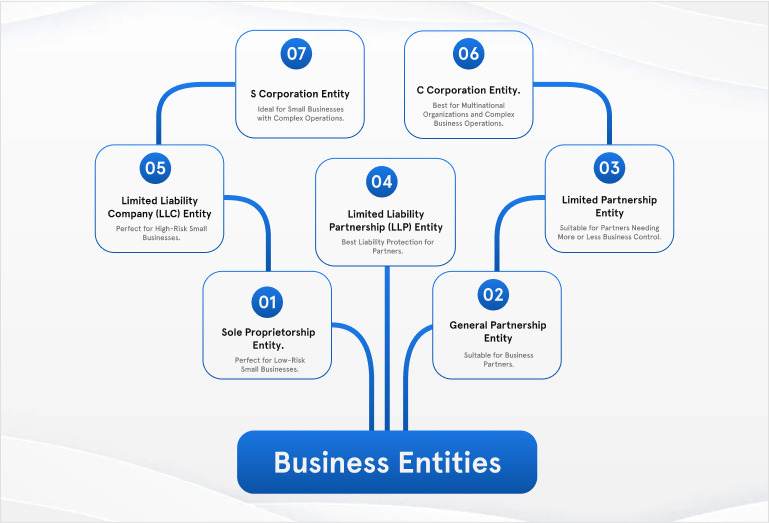

Understanding Entity Types and Their Tax Implications

When forming a business or managing finances, choosing the right entity type is a crucial decision with legal, operational, and tax consequences. The structure you choose affects liability exposure, tax obligations, and regulatory filings. Common Entity Types and Tax-Related Considerations...