Dissolving a business is a significant decision and involves more than just stopping operations. It's a formal process that requires careful planning and compliance with legal and financial obligations to ensure a smooth transition. Here's a comprehensive guide on business...

Entities Comparison Chart

Here's a comparison chart that outlines the key aspects of different entity types regarding ownership, tax treatment, liability protection, and tax filing requirements: Entity TypeOwnershipTax TreatmentLiability ProtectionTax FilingSole ProprietorshipSingle ownerIncome and losses reported on owner’s personal tax return; subject to...

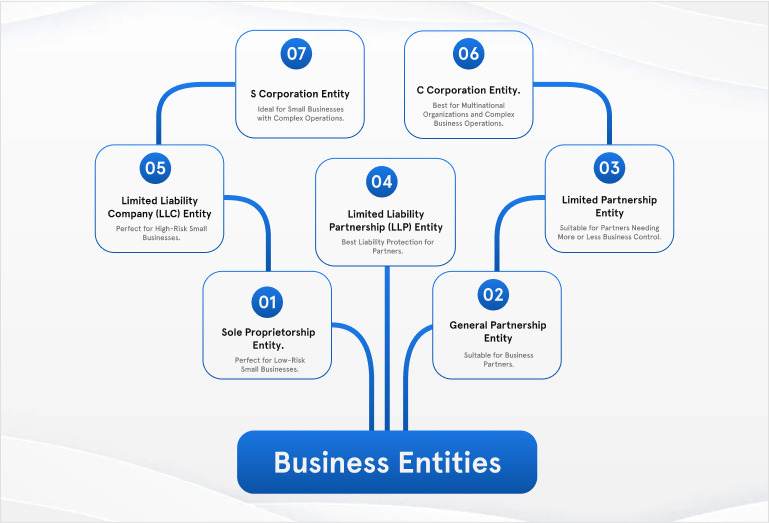

Understanding Entity Types and Their Tax Implications

When forming a business or managing finances, choosing the right entity type is a crucial decision with legal, operational, and tax consequences. The structure you choose affects liability exposure, tax obligations, and regulatory filings. Common Entity Types and Tax-Related Considerations...